Tamil Nadu

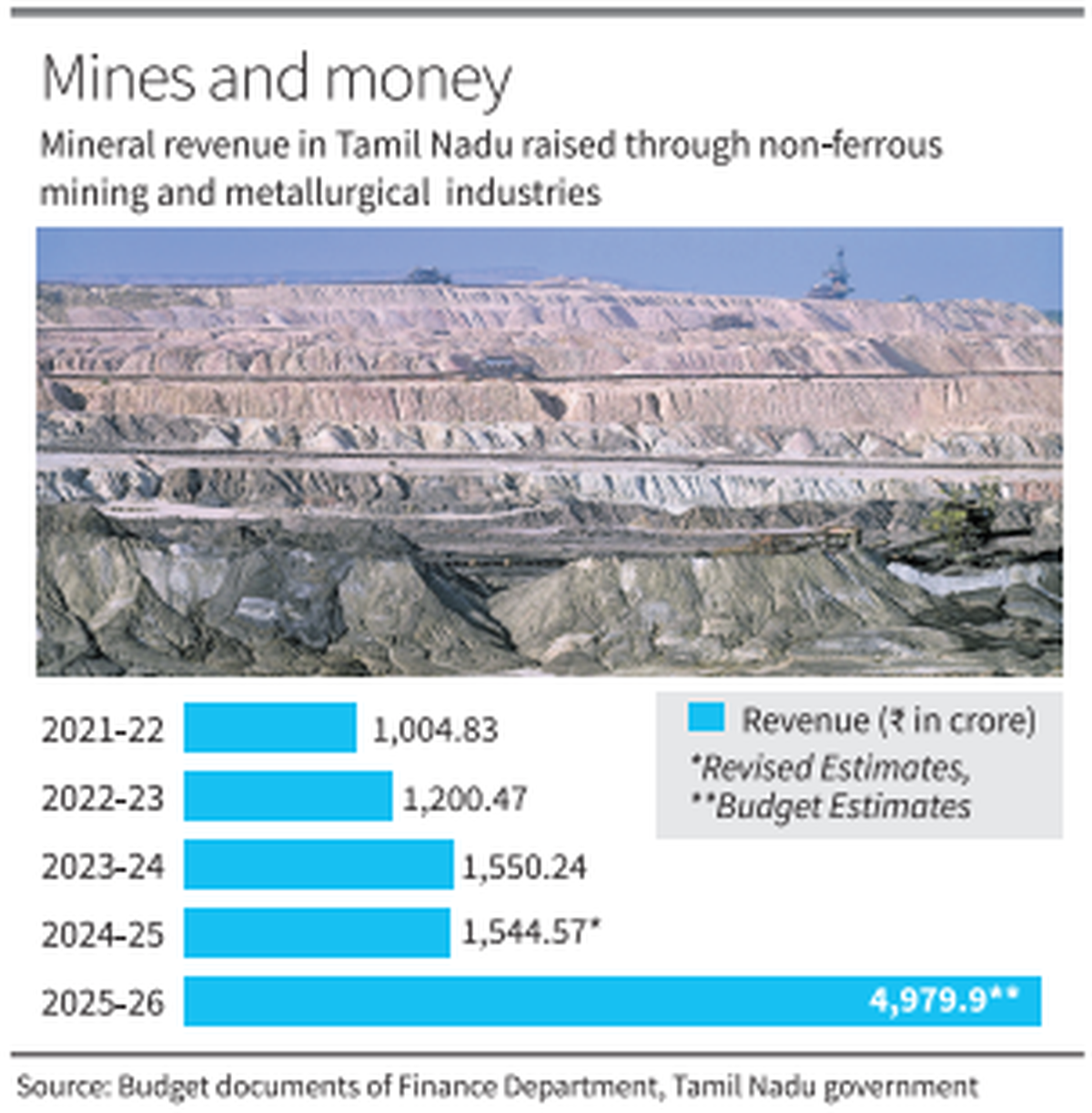

In that year, the revenue of the state government through the non-profit mining and metallurgy sectors could be about Rs 15,450 crore. (Representative photos)

Tamil Nadu is expected to pass the recently announced land tax law for mineral bearings in the period 2025-26 to a net deduction of approximately Rs 3.45 crore in the period 2025-26, which has been enacted after the Supreme Court’s decision last year, enabling states to tax mines and minerals.

In that year, the revenue of the state government through the non-profit mining and metallurgy sectors could be about Rs 15,450 crore. This is expected to reach Rs 49,800 crore. The figures were given in the latest budget paper submitted at the conference last week.

In view of the Supreme Court’s ruling last year, the government has framed the Mineral Bearing Land Tax Act, which was approved by Governor RN Ravi on February 20, 2025. In the legal timetable, the government has determined the costs of two types of minerals, one for the two categories of major, except for the Major, mineral oil and mineral oil and natural oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil and mineral oil.

For example, in terms of lignite, there is a provision of Rs 250 per ton. The highest ratio for the main mineral classes is Sillimanite Rs 7,000 per ton. As for the secondary minerals, the interest rate ranges from Rs 40 per ton for clay to Rs 420 per ton for black granite. As far as oil is concerned, crude oil is priced at Rs 8,500 per ton and natural gas is priced at Rs 3.5 per ton. However, the cement manufacturers have some retention on tax collections because they think it will drive up costs and they will have to pass it on to customers.

The Supreme Court concluded in its ruling in July last year that the Mines and Minerals (Development and Regulation) Act of 1957 [a Central Act] There is no power to deprive the state legislature of mining and quarries. It also clarified that the royalties for leasing mines are not taxable.

publishing – March 17, 2025 at 05:20 am